Should Some Clients Self-Fund for Long-Term Care?

Commonwealth partnered with Ash Brokerage to enhance the insurance marketing and operations functions available to our advisors. We worked closely with the specialists at Ash Brokerage to bring you this post.

Without a plan, a long-term care event can quickly derail a client’s income, retirement, and legacy. While the need for a plan is often clear, deciding on how to fund that plan can be a different story. Here, there are two distinct approaches to consider.

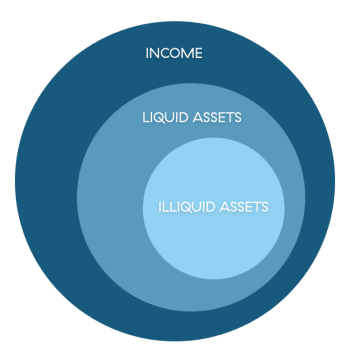

First, individuals or families may choose to self-fund (or self-insure) for long-term care, meaning they do not purchase long-term care insurance or any specific financial product. Instead, they rely on personal savings, investments, and assets to cover long-term care costs. The risk transfer is limited, as individuals retain all financial responsibility for their long-term care expenses.

Second, individuals can choose to purchase long-term care insurance or a linked-benefit policy, which transfers all or part of the risk to an insurance company. Conventional financial planning generally recommends transferring the risk of long-term care, even for high-net-worth (HNW) clients. And at Commonwealth and Ash Brokerage, our insurance partner, we would agree that there's some truth to this idea. But that doesn’t mean it's right for every HNW client.

So, how can you determine if your HNW clients, considering their distinct needs, should self-fund for long-term care? These five steps can help guide you through the decision-making process (click each heading to expand the section):

Sound Financial Planning

Ultimately, the choice to self-fund for long-term care depends on your clients’ financial situation, risk tolerance, and the level of financial protection they desire for potential long-term care needs. Starting the conversation as early as possible can help them make an informed choice—based on the available options—and keep their financial plan on track.

FREE DOWNLOAD

Advanced Financial Planning Strategies for High-Net-Worth Clients

Meeting the unique needs of your high-net-worth clients requires creative planning solutions. From long-term care to charitable giving, our guide’s got you covered.

Editor's note: This post was originally published in March 2019, but we've updated it to bring you more relevant and timely information.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.