It’s Time to Talk Differently About Charitable Planning with HNW Clients

The majority of high-net-worth (HNW) investors want to make a difference—even if they won’t get a tax break for it. Studies show that most of these investors—typically defined as those with a net worth of at least $5 million—view charitable giving as intertwined with their overall wealth strategy and not as an activity motivated by tax benefits. If you tend to emphasize the tax implications of various gifting strategies upfront, you may want to change how you approach charitable planning conversations with HNW clients.

By looking into the many ways that new HNW clients can give to a cause they care about, you have an opportunity to get to know what matters to them at the start of the relationship while helping them take a holistic view of how their philanthropy is tied to their wealth planning.

Some investors will come to these talks with specific causes in mind, often because of a personal connection (such as their alma mater, a family illness, or a community organization). Others will want help figuring out what should matter to them at this time in their life.

To meet them where they are, let’s discuss how HNW investors generally approach charitable giving and how you can help them be strategic in their philanthropy efforts.

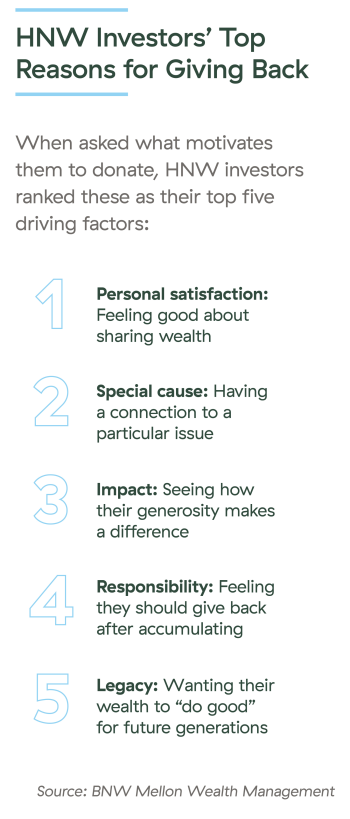

What Motivates Philanthropic HNW Investors?

In general, charitable giving is a top priority for this group of investors, while tax planning is toward the bottom of the list. In a 2022 BNY Mellon Wealth Management survey of 200 HNW investors, 91 percent of respondents said they include a charitable giving strategy in their overall wealth strategy.

In another study of affluent investors conducted by Bank of America and Indiana University, 72.1 percent said their charitable giving would stay the same even if the income tax deduction were eliminated, and 73.3 percent said their giving would not change if the estate tax were eliminated. The survey also reported that 88 percent of affluent households gave to charity in 2020, with an average of $43,195 given toward a good cause that year.

Still, some HNW investors are wary of being too philanthropic—in the BofA survey, 30.9 percent of affluent individuals said they prioritize the needs of their family first. Another reason is that some investors don’t know where to give or how best to go about it.

All of these trends provide opportunities to present ideas and resources, along with your expertise, when first meeting with HNW clients.

Being Strategic with How HNW Investors Give Back

There’s much to consider leading up to a conversation about charitable planning. The following steps can help you support clients by guiding them toward causes that match their interests, values, and overall financial picture.

Get to know the client. Bringing up the topic of charitable giving early on in the relationship can reveal a lot about your clients’ passions and priorities. What kind of mark do they want to leave behind? How much of their wealth do they want to dedicate to giving back versus leaving a legacy to their heirs? By asking the right questions, you can help them determine or narrow down the issues that matter most to them, such as:

What type of causes are most meaningful to you?

What organizations do you support year after year, and why?

Have you wanted to get behind a particular cause but are unsure which organization could make the greatest impact?

Resources like Fidelity Charitable tools can help clients think through their options. The site offers worksheets for determining why and where to give back, questions they could ask nonprofits, and calculators to estimate tax savings.

Be their philanthropy resource. According to the BofA study, nearly half of investors (46.6 percent) consider themselves novices when it comes to charitable giving knowledge, and only 5 percent view themselves as experts. You can fill this gap by being familiar with both resources and charitable planning vehicles, including private foundations, donor-advised funds (DAFs), charitable funds, and direct gifts.

To go further and make philanthropy a cornerstone of your practice, start with obtaining the Chartered Advisor in Philanthropy (CAP®) designation through the American College. During three online courses, participants learn about integrating estate planning with charitable planning, comparing charitable tax strategies and tools, and understanding how nonprofits are structured and governed.

Help them strategize. More often than not, donors use cash to give back, and most do not use a giving vehicle. This is where you can bring up more strategic, tax-efficient giving, like donating appreciated or complex assets (e.g., investment assets or closely held business interests, real estate, or collectibles). In such cases, clients can typically minimize their capital gains exposure and deduct the full market value of the assets they’re donating (if they itemize).

For a client who prioritizes philanthropy and wants to leave a legacy to family members, a DAF would be a fitting way to meet both needs. By potentially eliminating capital gains taxes and allowing for an income tax deduction, it’s a tax-efficient way to support a favorite charity while encouraging heirs to carry on the tradition of philanthropy by naming them as successor advisors.

Setting up a charitable remainder trust may facilitate the sale of an appreciated asset, with the tax liability spread out over time. Your clients could retain an ongoing income stream, for a period of time or for life, and take a charitable contribution deduction. Any remaining assets in this irrevocable, tax-exempt trust would be distributed to charity.

Even when taxes are not top of mind, you’ll need to be ready to explain the tax impacts of gift giving. Your role is to help clients home in on their passion while you find the most efficient ways to couple their passion with their planning. By so doing, your clients can have a significant impact on a cause they care about while ensuring that their generosity doesn’t undermine their financial future.

Starting the Right Conversation

Advisors and HNW investors may initially come at the topic of charitable giving from different angles. By getting to know your HNW clients’ main motivations and values, you can help them meet their goals—whether they want to make an impact, leave something behind for future generations, or address more immediate financial needs.

FREE DOWNLOAD

Philanthropic Giving for High-Net-Worth Clients

Understanding your clients’ charitable giving preferences can help you better anticipate their needs and help them achieve their goals.

Please consult your member firm’s policies and obtain prior approval for any designations you would like to use.

This material is for educational purposes only and is not intended to provide specific advice.

Please review our Terms of Use.